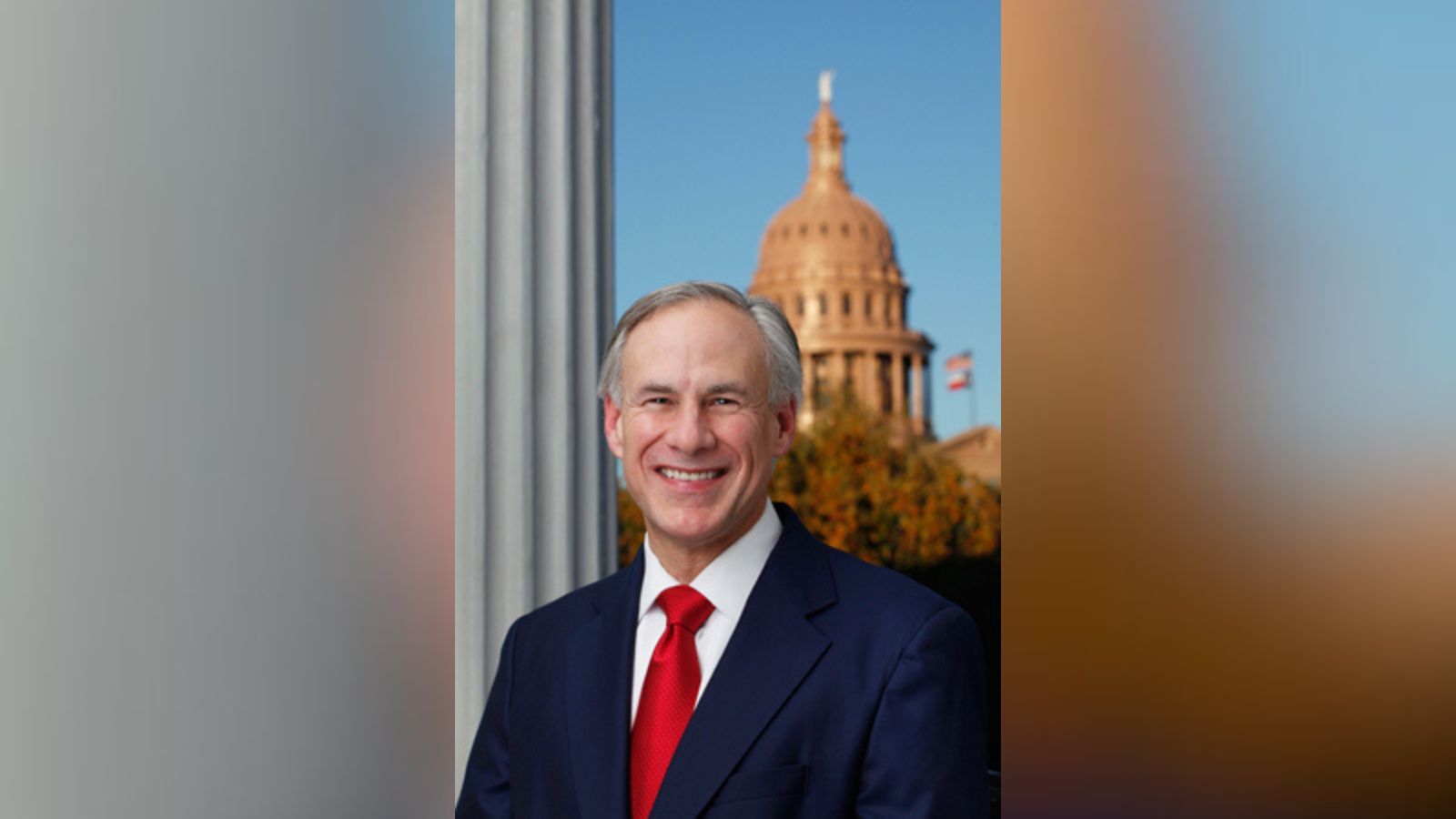

On July 22, Gov. Greg Abbott signed an $18 billion tax cut package for Texas property owners into law, signaling the conclusion to one of the hottest issues state lawmakers tackled during the most recent legislative session. The Texas Tribune reported that the measures – Senate Bills (SB) 2 and 3 – will subsequently be presented to the voters to approve in the November election.

“Hardworking Texans delivered the largest budget surplus in the history of our state,” Abbott said in a July 25 tweet. “That money belongs to them. I proudly signed into law the largest property tax cut in Texas history, delivering over $18 billion in relief back to taxpayers.”

According to the Texas Tribune report, Abbott made the Lone Star State’s distinction as having some of the nation’s highest property taxes one of the key platforms of his 2022 bid to remain in the Governor’s Mansion. The Austin-based online media outlet reported that SB 2, the property tax cuts bill, and SB 3, a franchise tax relief bill, passed both chambers of the Texas Legislature earlier this month, with House Joint Resolution (HJR) 2 slated to appear on the November 7 ballot.

Per the Texas Tribune, the cuts will take effect this year if they succeed at the polls.

Austin ABC affiliate Channel 24 reported that State Sen. Paul Bettencourt (R-Houston) penned the bills. The station reported that more than $12 billion of the package is earmarked for the reduction of the school property tax rate for all homeowners and business properties by nearly 11 cents, and homestead exemption for homeowners will jump from $40,000 to $100,000, among other things. “We’re giving back the people’s money, so we need the people to say yes," Bettencourt said in the report.

The Texas Tribune article reported state House Democrats failed to muster colleagues’ approval for their versions of tax relief. Under their plans, tenants would’ve received a cash refund equaling up to 10% of the rent they paid last year, and the homestead exemption would’ve been set at $200,000, $100,000 more than the figure in the present legislation, the website reported.