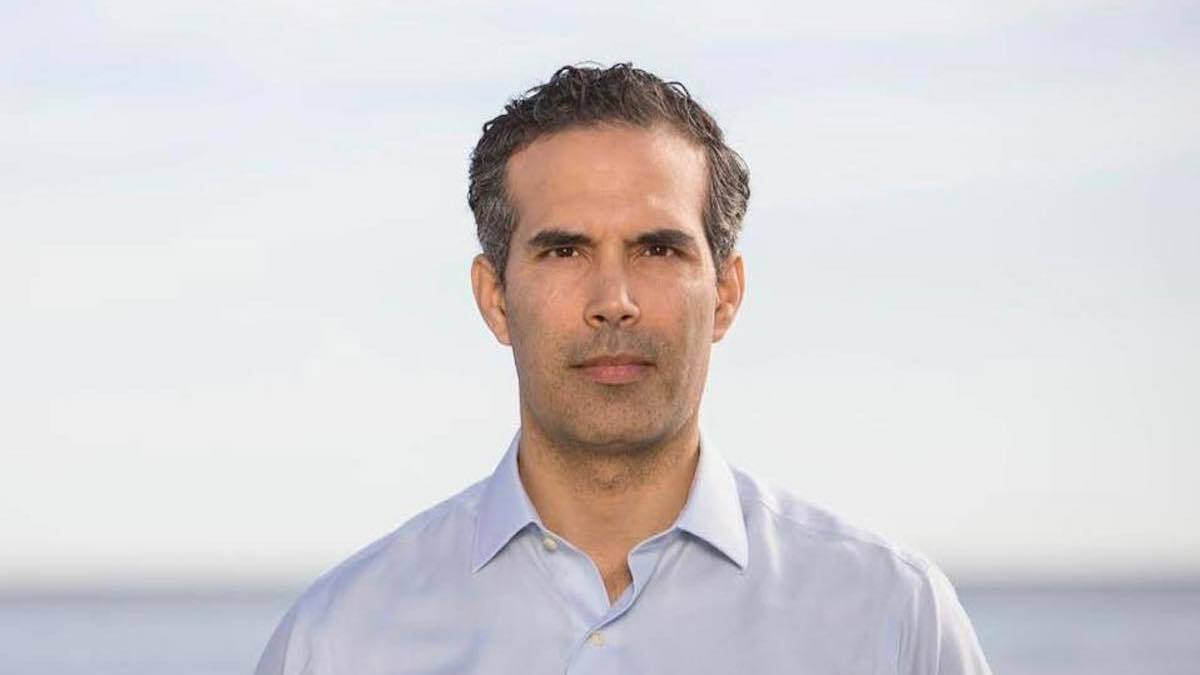

Just weeks after announcing his run for Texas Attorney General, current land commissioner George P. Bush is facing scrutiny over the revelation of strong financial ties between his office and Pennybacker Capital, an Austin-based private-equity firm he helped start in 2006.

Bush, the son of former Florida Gov. Jeb Bush, is set to challenge Attorney General Ken Paxton, who has served in office for the past six years under felony indictment for allegedly defrauding investors. During the launch of his campaign, Bush indicated that he would not shy away from drawing attention to the scandals surrounding Paxton, including recent accusations that Paxton bribed members of his own former staff.

"You've brought way too much scandal and too little integrity to this office," Bush said of Paxton at a kickoff event for his campaign in Downtown Austin on June 3. "And as a career politician for 20 years, it's time for you to go."

Before his foray into public office in Texas, George P. Bush help to found Pennybacker Capital, an Austin based private-equity firm.

Questions are beginning to arise regarding Bush's own potential improprieties relating to funding his office, the Texas General Land Office (GLO), provided to Pennybacker Capital. In 2017, the Texas Permanent School Fund contributed $75 million to Pennybacker Capital's Pennybacker IV project, helping the company to exceed its funding target. Documents obtained by the Houston Daily reveal that the investment was approved during a board meeting on Nov. 9, 2017.

The official website of the GLO notes that one of the duties of the office is to contribute funds and manage properties for the Texas Permanent School Fund.

"The Texas Constitution of 1876 set aside half of Texas’ remaining public lands to establish a Permanent School Fund (PSF) to help finance public schools. The land office manages these lands, including sales, trades, leases and improvements, as well as administration of contracts, mineral royalty rates and other transactions," the GLO states.

According to a 2019 PERE News report, the Pennybacker IV fund ultimately topped out at $510 million, meaning that the Permanent School Fund contributed about 15% of the total investment. Connecting the dots, The Texas General Land Office under Bush – via the State Permanent School Fund – is the biggest investor in Pennybacker Capital’s funds.

Pennybacker Capital is no stranger to controversy, having been embroiled in recent real-estate scandals in Austin. The company is connected to an alleged conspiracy to purchase loans on Austin commercial properties from banks through secret businesses, force the properties into receivership with assistance and use a court-ordered bidding process so the new loan holders obtain the underlying assets for no additional cost.

It could not be determined if Bush has publicly commented on the apparent financial connections between his office and Pennybacker Capital.